CASH MANAGEMENT ACCOUNT

Savings with a boost

Money in a conventional checking account is readily available but pays very little interest. Investments offer a higher return but money is often tied up and not easily accessible.

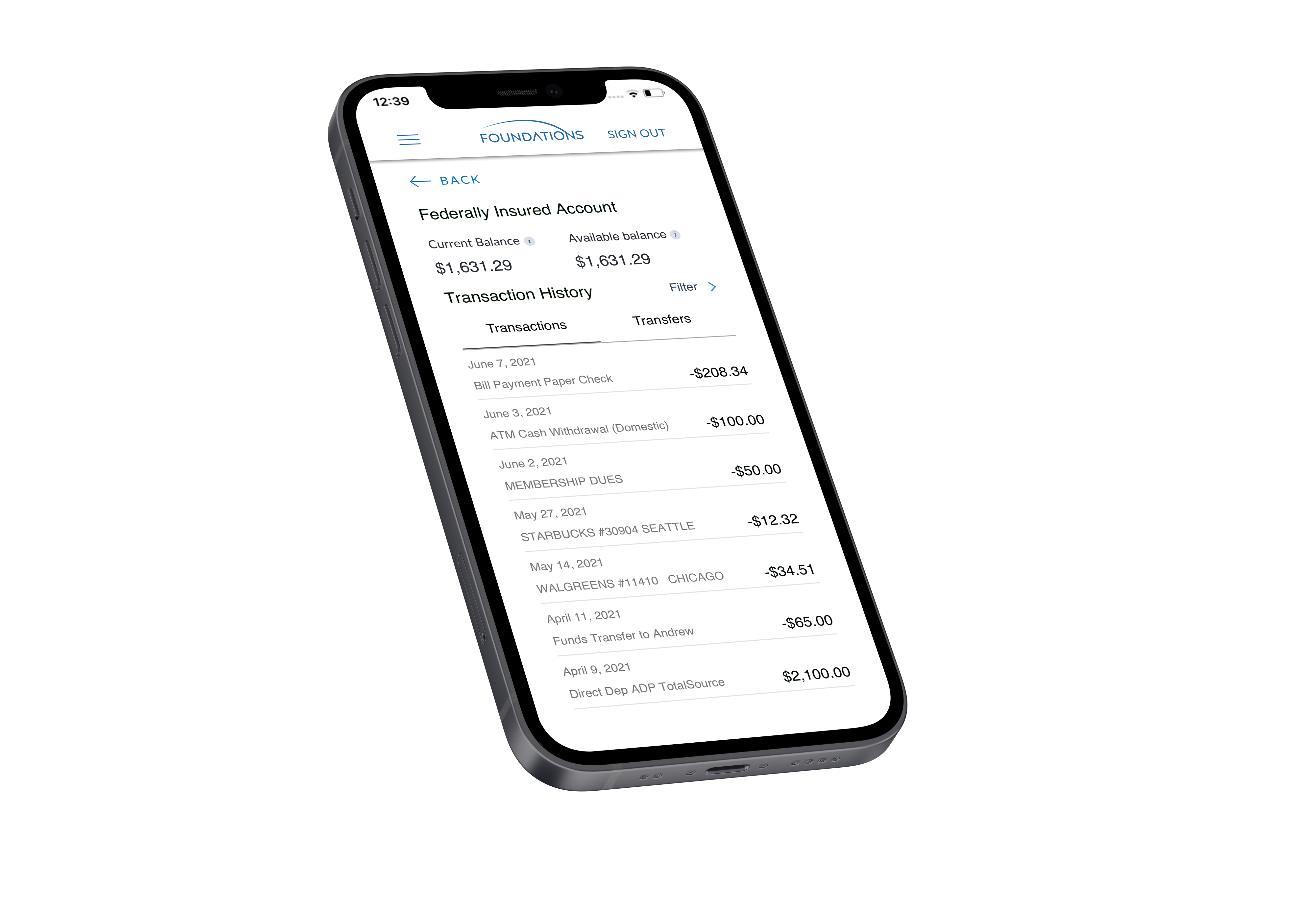

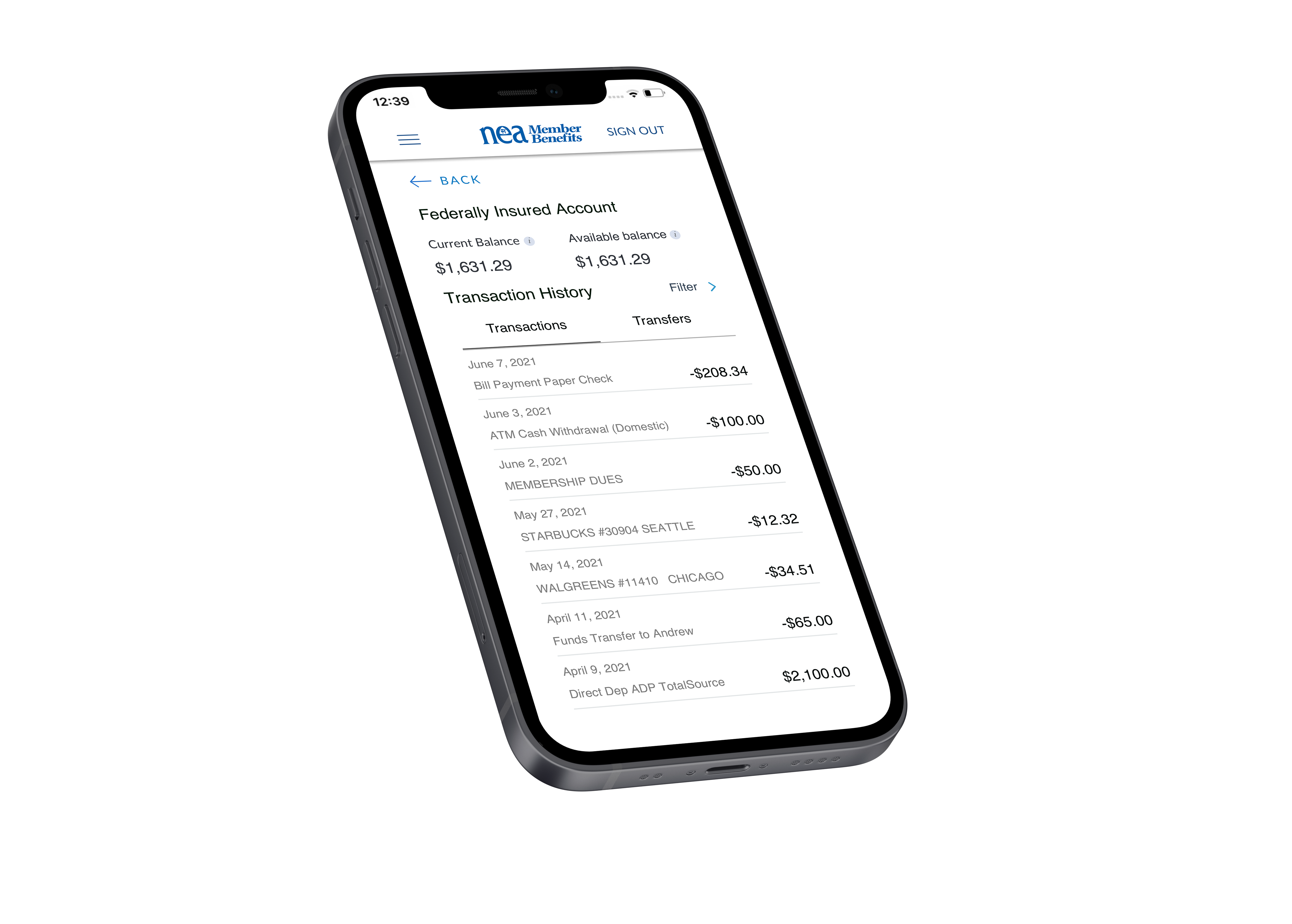

Our CMA offers a better home for your savings—the best of banking and investing in a single, easy-to-use mobile banking product.

An FDIC-insured mobile banking account that pays more on your everyday cash.

Integrated investment options offering much higher returns for even more growth.

Seamlessly move money between banking and investing accounts, and never incur overdraft or monthly fees.

OUR MISSION

Transforming individuals into investors with a simple, inclusive approach to finance

We believe investing is for everyone. That’s why we've made it easier—eliminating the high transaction fees, confusing choices, and delays in accessing investment holdings that have historically kept people from better managing their money.

Our Partners

We partner with the world's leading asset managers, financial advisors, corporations, and community organizations to create unique CMAs for their clients, employees, and members. We provide a fully customized product, including a branded mobile app, web portal, and Visa contactless debit card.

Already offer a banking product? Using our proprietary APIs, we can integrate our unique CMA platform into your current product construct. You can keep your existing debit cards, bank issuer, processor, and card network.

Ventures

Company

Ventures

Company