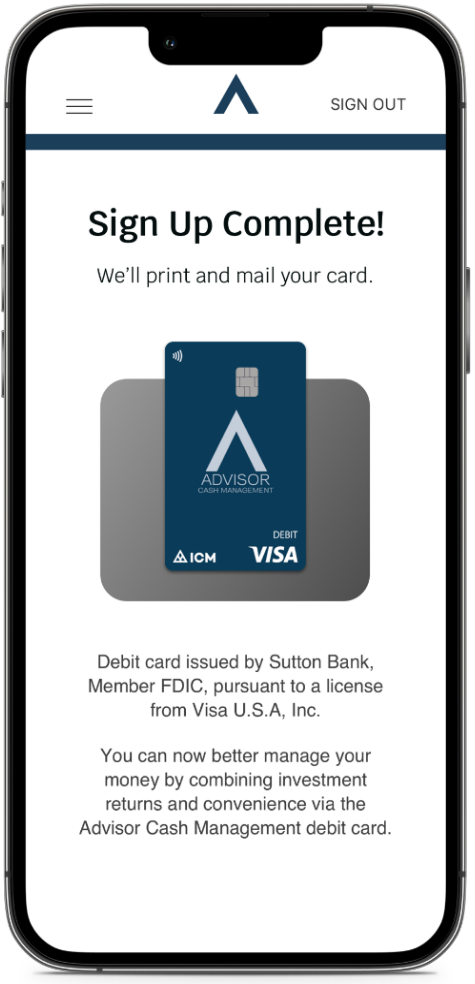

Introducing a modern cash management account that offers your clients a

higher return with instant investment liquidity.

Discuss your needs with our integration team to determine the ideal cash management solution for your clients.

Launch your branded experience with ICM's platform—fully customizable with your firm’s branding and client preferences.

Monitor client engagement and performance with real-time insights into balances, transactions, and investment behavior.

For more information and answers to your questions, please contact us.